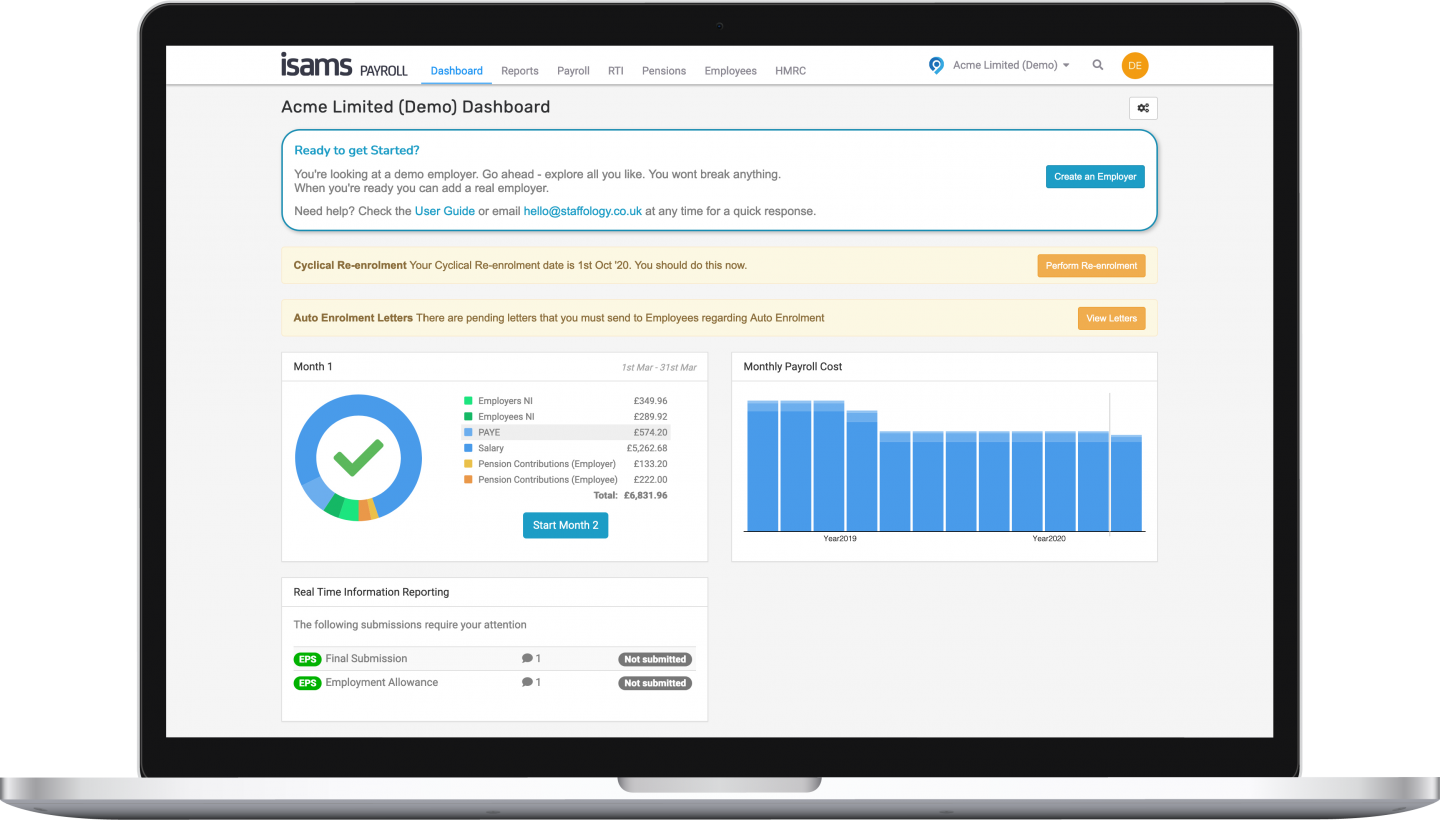

Manage every staff pay run through one HMRC-recognised, cloud-based payroll system

Take complete control of your payroll management with our specialised iSAMS payroll and pensions software that’s tailored to suit the needs of UK-based Independent schools.

Take control of your payroll

Payroll managers have access to powerful functionality that allows them to take control of the payroll process with this dedicated solution. They can lock down payroll once the cut-off date has been reached and securely store data for the next payroll run. All processes can be tailored and controlled based on your needs by including manual steps or approvals, which improves payroll accuracy and ensures compliance with regulations.

Payroll features for UK Independent schools

This dedicated solution works seamlessly with the UK Teachers Pension Scheme and Local Government Pensions Schemes, as well as major occupational schemes such as NEST. Pension tier information is automatically downloaded into the system, and contribution calculations are made at post level, ensuring your team is making the right contributions every month.

Run auto-generated Monthly Contributions Reconciliation (MCR) and auto-calculation of retrospective pay increases, with tax and pensions changes applied. Our built-in link to the UK HMRC Data Provisioning Service (DPS) automatically pulls in tax code changes and student loan information, so staff don’t miss key contributions.

Our payroll solution offers powerful functionality, including the ability to lock down payroll once cut-off has been reached and store data for the next payroll run. Processes can be tailored to your department’s individual needs by including manual steps or approvals, boosting accuracy and compliance.

iSAMS Payroll is fully HMRC-recognised and Real Time Information (RTI) compliant and the software continually updates to meet any new legislative requirements in the sector.

Support various job roles, salary structures, and term-specific agreements with iSAMS Payroll. The solution also offers streamlined retroactive payment calculations, pension level categorisation, automatic position-based computations, reporting for the UK Local Government Pensions Scheme (LGPS) and the UK Teachers’ Pension Scheme (TPS).

Build a totally integrated HR and payroll system thanks to open-AI for easy connection and a software solution that works to meet your specific requirements and maximise team efficiency.

Secure, cloud-based Payroll management

As you’d expect from iSAMS, Payroll is completely cloud-native and works through a web browser, so there’s no infrastructure to maintain or updates to install, saving time and money – and there’s no need for backups or disaster recovery plans as is required for on-premise software.

Staff can work remotely, supporting flexible working for today’s HR staff, and the system facilitates access on any device 24/7, 365 days a year, enabling employees to securely access their pay information.

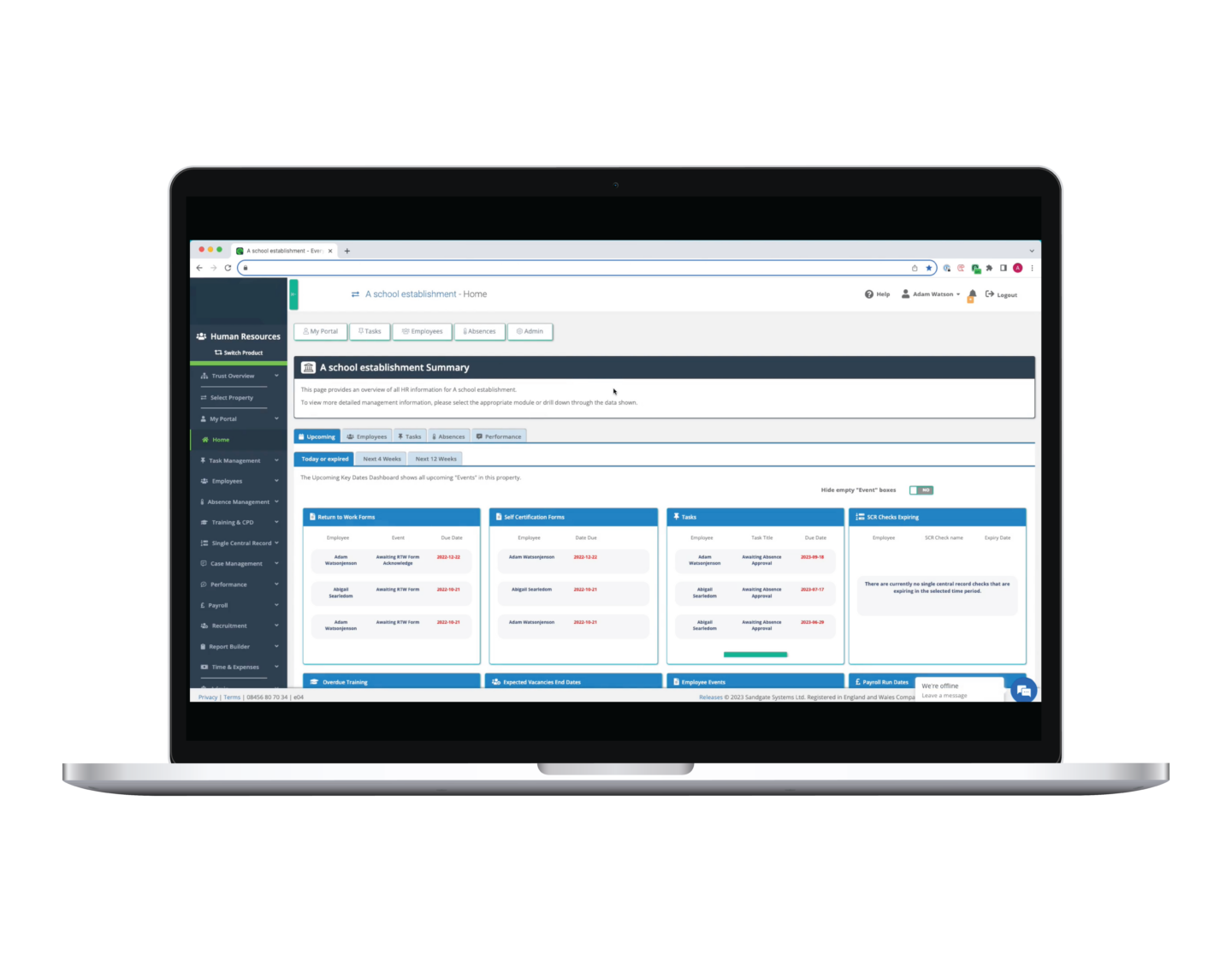

Connect your HR and Payroll functions efficiently

For a comprehensive, streamlined approach to managing your HR and Payroll functions, we highly recommend combining our Payroll solution with our HR system. By doing so, employee details are automatically synced and carried over to your pay run, eliminating the need for duplicate data entry, which in turn minimises the risk of GDPR breaches, saves you time and ensures the accuracy of payroll information. Payslips are also automatically loaded to the Employee Portal in HR for easy access and viewing.