COBIS Conference for Bursars, Business Managers and HR Staff – Visit us from 31st January – 2nd February 2024 in London, UK.

Over 1,500 schools trust our system to support the future of education and development of students.

Developed specifically with the bursars and business managers in mind, bring your academic, wellbeing, administrative and fee billing elements together with a powerful accounting and finance solution.

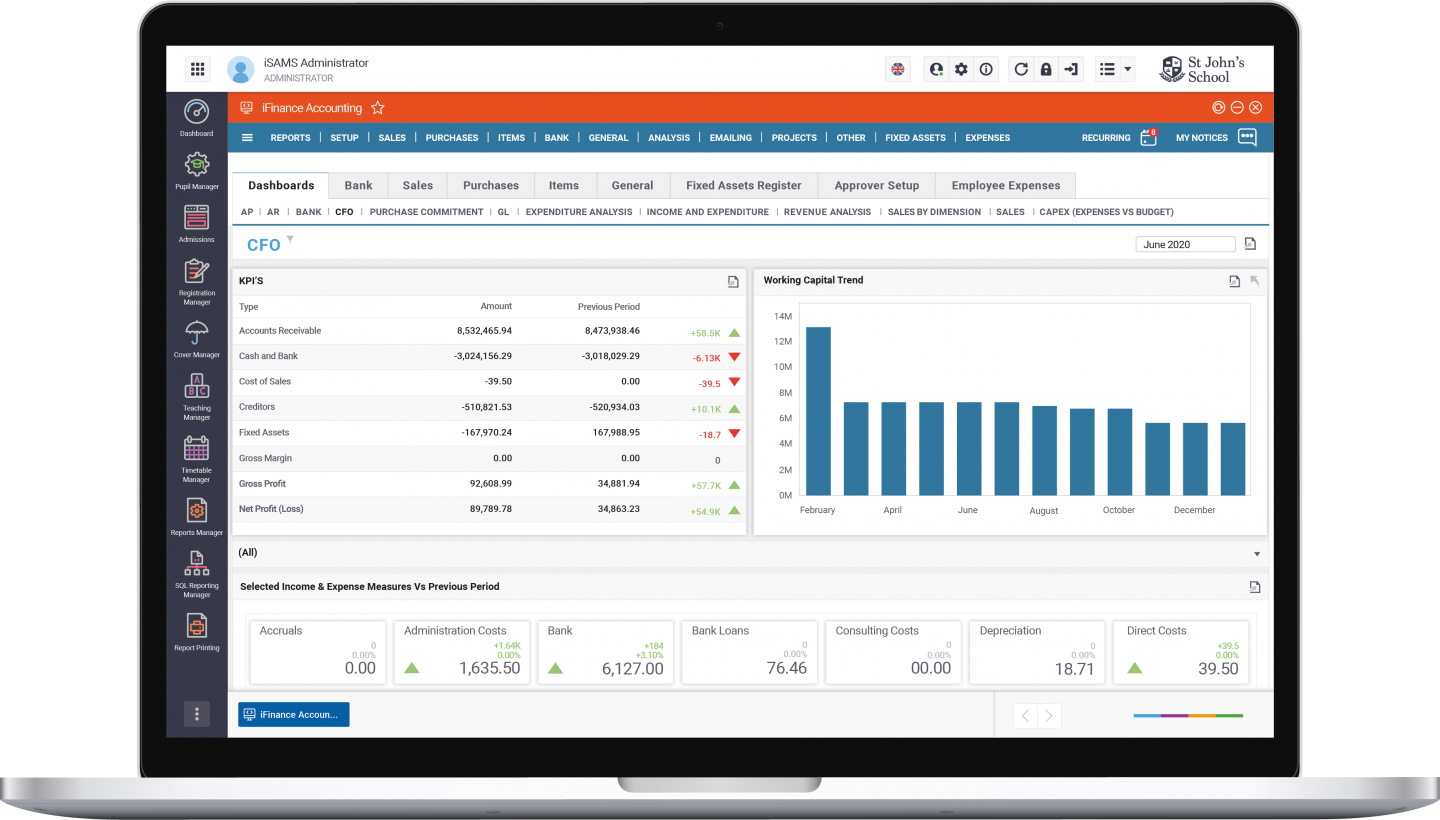

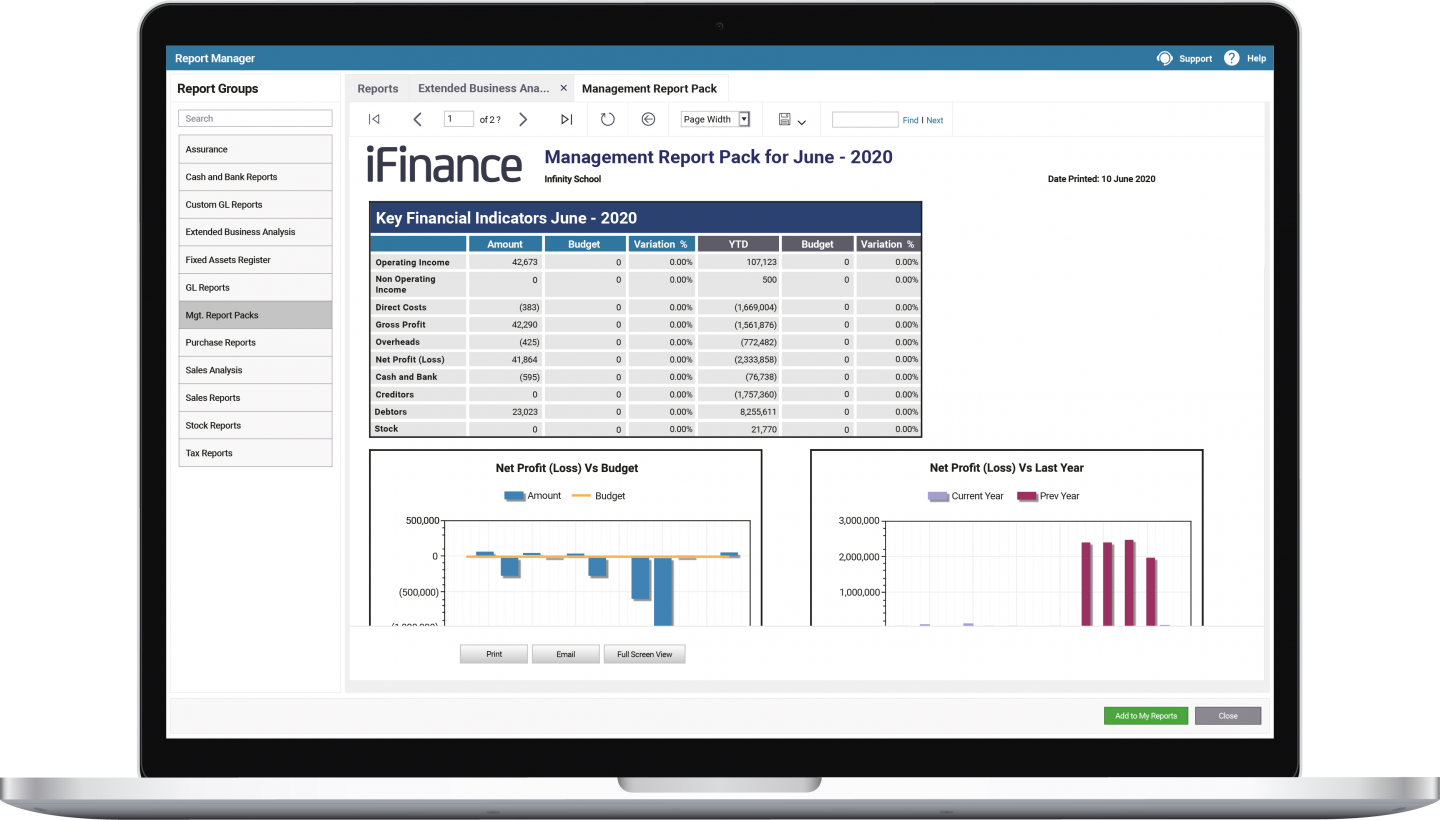

Powerful Accounting

The iFinance accounting, consolidation and business intelligence features offer your bursary the ability to generate predefined and custom reports, profiled by user. The fully-interactive reporting means you can drill down to transaction level and produce a customised analysis, which can then be exported to Word, PDF or Excel. The Auto-Bank Reconciliation enables you to speed up the allocation process, uploading your bank files and posting transactions in a time efficient manner. Plus, the customisable online workflow approval process will allow your school to adopt a paperless purchase order and invoice environment, allowing your key stakeholders to see a live status of their budget.

Comprehensive Flexible Billing

The iFinance fee billing feature allows your account department to generate bills and add charges in several different ways for specific applicants, current students and alumni. It also enables your bursary to amend invoices and synchronise this data with a sales and nominal ledger. Not only this, but the flexible deferred income functionality removes the need for monthly journals to be calculated and posted. You’ll also be able to use a comprehensive suite of interactive reports for pre and post invoice, historic invoices and ad-hoc reports.

A feature rich finance platform

With our workflow approval, you’re able to automatically send paperless POs and purchase invoices for approval before they are posted to the accounting system, including options to add customisable layers of approval. You can also save time by creating an auto-approval process for reviewing or approving invoices by authorised personnel. Keep your data secure and track each request with a real-time view of the status of approval.

All your company and group assets can now be managed and stored via this single database, without the need to switch between multiple systems. Quickly approve fixed asset POs or invoices through our workflow approval and App. Upload accompanying documents with our document management functionality, schedule dates for maintenance or renewal, and link assets to leases or loans. Plus, manage your assets with automated depreciation journals and fixed asset schedules – with CapEx forecasting offering you greater assistance in your financial planning.

Employees can record expenses and outlay against internal or external projects and managers to approve. Enjoy our easy-to-use Expenses Capture App to add photos of expense items or receipts, submit expenses to line managers, start-stop mileage claims using Google Maps and easily route expenses for client recharge and tag as paid or to be reimbursed – all with ease on your smartphone. Lock fixed expense items to reduce the risk of error and avoid multiple submissions for the same expense claim, whilst integration with the finance ledger ensures expense claims are automatically paid once approved.

Integrate purchasing to automatically track stock levels, so you know how much stock you have available at any one time and when you might need to order more. Integrate with ePOS, shopping cart and CRM systems to avoid the duplication of data across multiple platforms and retain a more holistic view of your finances.

Simplify monthly consolidations across each of your designated groups with different subsidiaries, currencies and account structures via a separate SQL database. Plus, you can access these consolidated results in real-time via this single system.